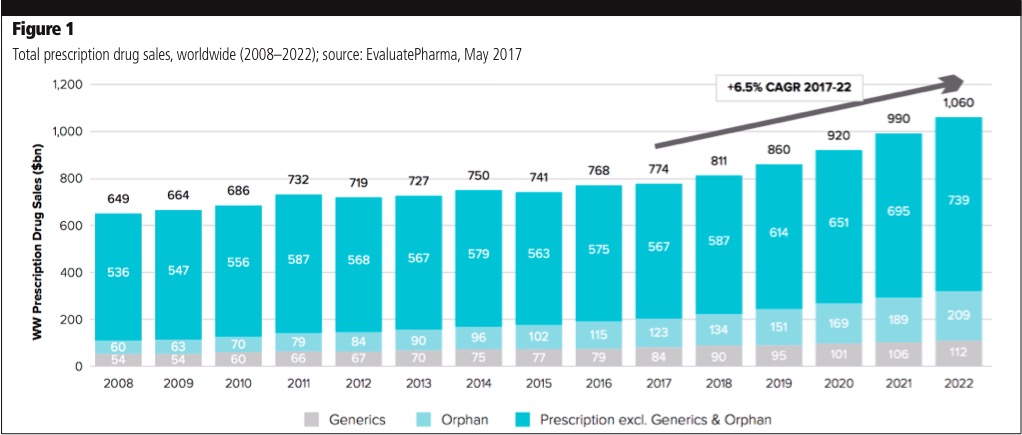

World Preview 2017, Outlook to 2022, published by EvaluatePharma, is an interesting report.1 There are similar reports published every year and, from a sales perspective, these reports might be useful to some. However, I have not yet seen a report that translates or equates sales numbers to number of patients served and/or affordability. As developed countries (haves) and developing countries (have nots) are two distinct customer bases, it would be useful to understand drug expenditure spending per person, per day, for each market. The resulting numbers could be used to understand and develop plans to improve global sales and the affordability of drugs. These numbers might also tell us whether the projected sales from other forecasters can be achieved, where the sales could come from and what steps need to be taken to achieve the projected sales and make the product more affordable (Figure 1).

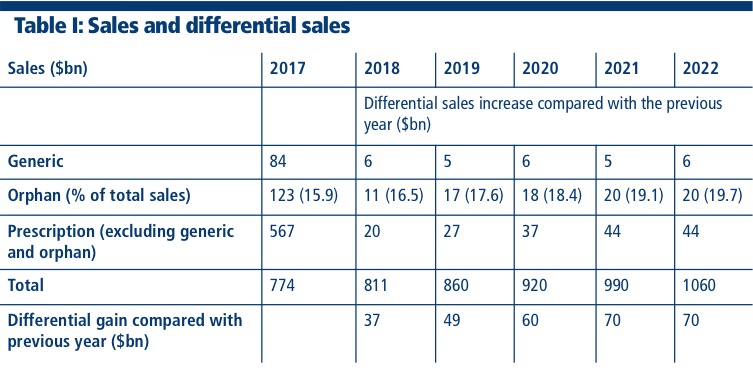

Numbers from Figure 1 are listed in Table I and demonstrate what is required to meet sales projections. The numbers in Table I seem to be realistic and obtainable; however, the projected sales increase for each year is equivalent to the revenue of one or two of the top five pharmaceutical companies for the next 5 years.2 Therefore, achieving these numbers is easier said than done. An earlier alternate study reviewing drug prices and number of patients might be of interest.3

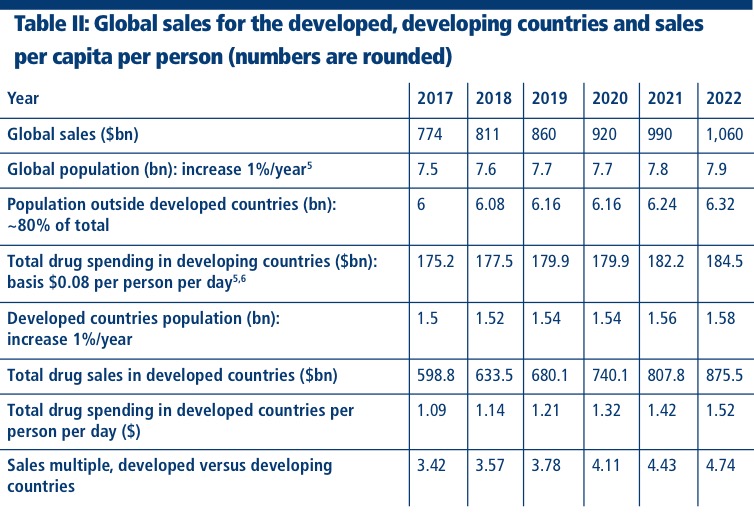

Table II has been created using the sales forecast from Table I. The population of the developed and the developing countries and average sale per person per day in the developing countries are used to determine the sales for the developed countries.4 Average sales per day per person for the developing countries, including the rest of the world, might be considered low; but, using the available data and extrapolating it, it’s the best number I could derive.5,6 I am comfortable with the developed numbers.

In my travels and personal experience, I have seen that prices for prescription and generic drugs in developing countries are significantly lower than the prices for the same prescriptions in developed countries. However, even with low prices, people in developing countries have to decide between food for the family and drugs for the ill as a result of low incomes.7 Based on the sales increase from 2008 to 2016 (Figure 1), one can speculate that projected 2022 sales will mostly come from developed countries, rather than developing countries. Orphan drugs (less than 200,000 patients per disease) are going to be an ever-increasing source of revenue and, as a result, Brand Pharma has shifted its focus from drugs for the masses to orphan drugs. It is well-known that orphan drugs increase revenue dramatically as they are very highly priced and also highly profitable. New drugs are being introduced continuously, but most are only marginally better than the drugs already on the market and are equally expensive.8 As a result, they are unaffordable to many and frowned upon even by physicians and healthcare systems. For example, PCSK9 is a class of drugs for cholesterol that will have a very limited market.

In recent years, there has been a focus on increasing the prices of drugs rather than developing affordable drugs. “Rather than compete by lowering net prices, the drug companies compete by raising list prices,” notes Berman, of Hagens Berman Sobol Shapiro, making an interesting point about how pharmaceutical companies raise revenue.9

Affordability in the developing countries is critical for sales. Merck, in 2008, had to significantly lower the price of Januvia in India, a country with the highest population of individuals with diabetes.10 Affordability forced patients to stay with metformin hydrochloride or other drugs compared with Januvia. HIV drugs were unaffordable to many in Asia and Africa until Cipla intervened and the Gates and Clinton Foundations supported the move, although they remain expensive in the United States.11 If infectious diseases were not present in developed countries, it’s possible that some companies may not have developed the necessary drugs.

HCV drug Sovaldi, sold in the US at $84,000, is sold in India and other countries for less than 200 times the US sale price by Gilead, through its arrangements with local pharmaceutical companies.12 Compulsory licensing is part of the WTO agreement and has been used to lower drug prices in developing countries, which is not ideal for branded drug companies.13 However, affordability is critical and branded companies occasionally forget that some of their customers cannot even afford food at times.7 Another important fact that brand companies forget is that they have more patients in need of the drug in developing countries than in developed countries. Economies of scale can lower costs and improve profits!

Even with an excellent mutually subsidised healthcare system, it is well known that many patients do not take their drugs as prescribed.14–16 Table II shows that sales in developed countries are going to stay at about four times the sales of developing countries. This is very telling, especially when the population of the developing countries is about four times that of the developed countries. This lopsided arithmetic suggests that pharma companies have tremendous opportunities to increase their sales if drugs can be made more affordable.