In this year’s Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, from BioPlan Associates, we include surveys of 130 bioprocessing decision makers in 33 countries, both developers and contract manufacturing organisations (CMOs), and 150 industry supplier/vendor respondents. Just a few of the key areas where we see bioprocessing trends affecting growth include the following:

- hiring in bioprocessing will continue to create significant bottlenecks; finding qualified staff at global facilities continues to be a problem

- biological products, often each with smaller markets, including more orphan and even personalised products

- bioprocessing facilities worldwide, especially in major markets and in China, where 20% annual expansion is the norm

- cellular and gene therapy facilities and products, including commercial manufacturing

- use of single-use systems, including fewer new commercial-scale stainless steel-based facilities

- growth of GMP facilities in developing countries

- biosimilars, biobetters and biogenerics are capturing growing market shares in bioprocessing

- adoption of continuous processing, including upstream perfusion and continuous chromatography for commercial manufacturing.1 Industry adapting to address the pandemic

- more outsourcing, with 70% of developer interviewees citing this

- changes in supply chains, with 60% of developer interviewees citing this, including more concerns about and involvement with suppliers, and securing second sources

- more regionalisation, cited by 50% of developer and 45% of supplier interviewees; this refers to more manufacturing facilities being located in more countries, such as a plant in the US supplying the US market whereas those in China and India handle the Chinese and Indian markets

- SUS supply crunch, cited by 50% of developers and 35% of suppliers, including the worsening of current single-use equipment shortages.

- average titre for new commercial-scale monoclonal antibody (mAb) upstream bioprocessing this year is 3.53 g/L and 3.96 g/L for new clinical-scale mAb upstream bioprocessing

- “Improving production titre” was cited by 56.5% as a key factor having the greatest impact on reducing your cost of goods for biotherapeutic products.

- E.S. Langer, et al., Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 17th Annual Edition (BioPlan Associates, Rockville, MD, US, April 2020): 527 pages.

- https://bioplanassociates.com/wp-content/uploads/2020/07/Covid-19-Impact-on-Bioprocessing-White-Paper-BioPlan-20200605.pdf.

- www.biosimilarspipeline.com.

- https://bioplanassociates.com/china-cmo.

In a recent whitepaper covering COVID impacts, we found that the bioprocessing sector and biopharmaceutical industry have effectively adapted to the ongoing pandemic, including making needed staff and operational changes and paying greater attention to assuring robust supply chains.2

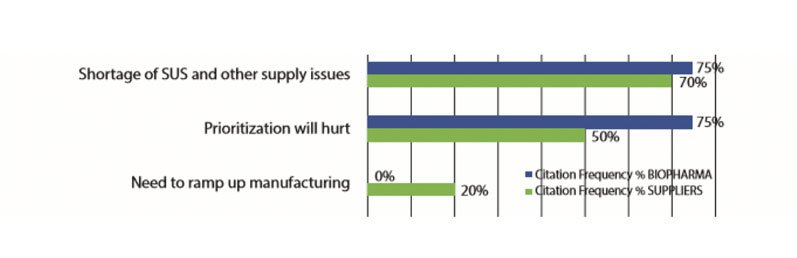

Key activities have largely continued as before, including R&D and manufacturing often being increased to address the pandemic. The most commonly cited fears are shown in Figure 1.

Figure 1: Top-level near-term fears owing to the COVID-19 pandemic

The top fears noted were “Shortage of SUS (single-use systems) and other supply issues,” concerns about the inability to obtain needed SUS in a timely manner and “Prioritisation will hurt.” Prioritisation concerns refers to the new fact of life that nearly all suppliers and many developers are now prioritising their orders and activities, pushing pandemic/biodefence-related activities to the front of the line.

Prioritisation combined with the expected worsening of ongoing shortages, including high-purity polymers, will result in many facilities having longer wait times for suppliers to fulfil orders, particularly for single-use supplies.

Long-term biopharma industry changes owing to the pandemic

Big changes will come in the longer-term as the industry does its part to resolve the COVID-19 pandemic. The major response will be an expansion of biopharmaceutical R&D and manufacturing activities worldwide — which is displacing other bioprocessing work to alternative facilities.

For example, smaller CMOs not involved in pandemic-related work are seeing increased future demand as pandemic/biodefence projects are undertaken by larger CMOs. A few of the factors on the list of major long-term effects of the COVID-19 pandemic on the bioprocessing sector include

Productivity continues to increase

Bioprocessing productivity, particularly in terms of upstream titres and downstream yields (to a much lesser extent), continue to incrementally increase. Related survey findings this year include

Follow-ons bring more products and players

Biosimilars (and biogenerics in lesser and non-regulated international markets) are resulting in many new products and players entering the biopharmaceutical industry, including new facilities being constructed.

Our Biosimilars/Biobetters Pipeline Directory now reports 1099 biosimilars (including biogenerics) in development or marketed worldwide, with 588 now in clinical trials or marketed in one or more countries.3 There are also more than 560 biobetters in development or marketed worldwide, with 296 in clinical trials or marketed. More than 800 companies worldwide are involved in follow-on products.

Eric Langer

Capacity crunch for cellular and gene therapies

The distribution of capacity among survey respondents reporting that their facilities do cellular/gene therapy bioprocessing is insufficient. BioPlan has projected a worsening cellular and gene therapies “capacity crunch” that’s similar to the crunch in mainstream bioprocessing that was feared but avoided in the early 2000s. This shortfall will increase in 5 years.

Continuous bioprocessing optimism and scepticism

When asked in our annual report and survey what bioprocessing innovations are most needed, respondents continued to most frequently cite aspects of continuous bioprocessing. “Upstream Continuous Processing/Perfusion” was cited by 44.2%, and “Downstream: Continuous Purification/Chromatography” systems were cited by 40.0% as expected to be evaluated/tested by their facility within the next year.

It can be assumed that a majority of bioprocessing facilities will evaluate at least some part of continuous processing this year.

But there is also considerable scepticism about continuous bioprocessing, with more than 60% citing that it will “require many years development to become truly continuous.” And in response to rating concerns regarding perfusion, 71.8% cited “Process Operational Complexity” as their top concern, reflecting that perfusion adds considerable mechanical, technical and regulatory complexities to bioprocessing.

Single-use systems use still growing

SUS continue to make advances into biopharmaceutical manufacturing and now dominate at precommercial scales (clinical and preclinical). More than 80% of survey respondents reported considerable current use of single-use bioprocessing equipment.

Fully 84.3% now report use of single-use bioreactors. Use of these generally indicates much wider applications of single-use equipment as part of the same processing lines. BioPlan estimates that ≥85% of precommercial (R&D and clinical) product manufacturing now involves very substantial SUS-based manufacturing.

Hiring challenges creating significant bottlenecks

As the industry expands, hiring will present major problems, especially when growth is involved, such as in cell and gene therapy. We asked respondents which job positions are currently difficult to fill. Of the 25 areas covered, downstream process development staff was again cited as the most difficult to fill at 39.5% of respondents (slightly down from 45.1% in 2019). See more in Figure 2.

The apparent lessening of hiring problems in some areas may be that companies are being more successful in streamlining their processes, making them more automated and less expensive. This can reduce pressure on already minimised staff.

Figure 2: Select areas where hiring difficulties exist in biopharmaceutical operations

The steady growth in bioprocessing will be suppressed by demand for staff. The need for trained bioprocessing expertise has remained stubbornly in place, year after year, and it will likely worsen as many of the most experienced “baby boomer” staff retire, and pandemic vaccine and therapeutics bioprocessing — as well as growth in developing regions such as China — add to demand.

Biologics CDMOs in China

Growth of the domestic Chinese mAb pipeline, regulatory reforms and new investment opportunities are changing the region’s landscape for biologics CDMOs. Both multinational and domestic Chinese biopharma companies are assessing the new business opportunities in China’s booming contract biomanufacturing segment.

New biologics CDMOs are setting up as investor interest in the sector rises with recent regulatory reforms and growing market demand. BioPlan’s research for its Top 100 Biopharmaceutical Facilities in China Directory now shows more than 100 biopharma companies in China, both new and established, that have started mAb development projects.4

Many of these product innovators have limited experience in actually manufacturing a biologic; so, as with Western innovators, they are increasingly turning to CDMOs. The Chinese government also provides subsidy programmes for CDMO companies.

Boehringer Ingelheim, the first multinational CDMO to test the water in China in 2016, announced plans to expand its capacity owing to growth in demand in 2019. Lonza, the global giant in the CDMO industry, made a strategic move to enter China at the end of 2018.

Korea-based Celltrion also announced plans to build bioproduction facility in Wuhan in 2019. Dozens of domestic companies, existing CRO companies as well as brand new start-ups kicked off their biologics CDMO business as more mAb therapeutics enter the clinical pipeline and reach commercial scale.

Since the successful launch of Langmu in 2013, Chinese developers have submitted IND applications for 109 Class I biological therapeutics, so the need for CMOs is likely to continue. And, because biopharma is a global segment, the trends and bottlenecks experienced by Western facilities, if not already present in China, will impact that segment in the near future, as well.

References

The original version of this article was published in the CPhI Annual Report 2020: Postulating the Post-COVID Pharma Paradigm and is reproduced with kind permission.