Ingredients have never officially been covered by existing pharmaceutical good manufacturing practices, although recently regulations such as the Falsified Medicines Directive in the EU and the FDS Safety and Innovation Act in the US have tried to fill this gap.

As more API and excipient manufacturing moves to India and China, there have been increasing complaints of variable quality and tightening supply. This has led to the development of formal cGMP guidelines for excipients and third-party supplier auditing and qualification programmes.

According to CPhI Pharma Evolution, part of UBM Live’s Pharmaceutical Portfolio, in its first monthly report into the current status of the formulation and ingredients market based on a survey conducted among high level executives and experts from across the industry, more than half of respondents (55%) said that supplier certification was extremely important to them, with a further 39% describing it as somewhat important. But more than three-quarters of those surveyed admitted that they were not actually working with any third-party auditors to assess their suppliers’ quality.

‘Ninety-five per cent said that it was at least somewhat important that suppliers be certified to third-party standards, yet they want to do their own audits,’ said Irwin Silverstein, VP and COO of IPEA, the first third-party excipient auditing organisation, which, together with the Pharmaceutical Quality Group, drafted the cGMP requirements for excipient suppliers. ‘If they are not working with third-party auditors to verify supplier compliance with GMPs, how can they ensure that suppliers meet their expectations for GMP compliance?’

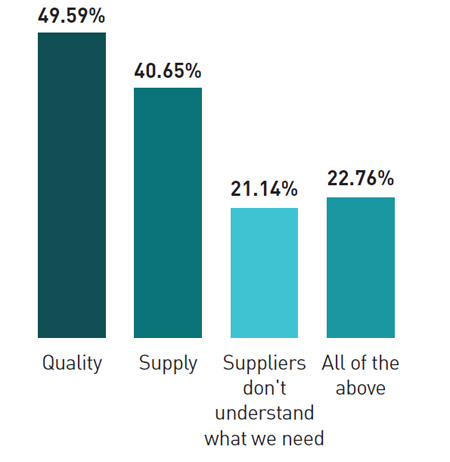

Roughly half the respondents said that API and excipient quality was a major issue for them . More than 40% said they were very concerned about API and ingredient supply, while at least 21% complained that suppliers don’t understand their requirements; 22% complained about all three of these issues. This, the report suggests, indicates that there is a need for closer alignment and communication between API suppliers and buyers.

What are your top issues with API and ingredients?

‘The combination of concerns over quality, supply, and lack of understanding suggests a need to move to more pharmaceutically aligned suppliers,’ says Brian Carlin, Director, Open Innovation, at FMC BioPolymer, an expert in excipients. ‘However, if inconsistency of quality is due to unknown excipient attributes, beyond the certificate of analysis, part of the problem may be inadequate feedback to the suppliers. Suppliers cannot help if they are not made aware of application requirements.’

India is the main source for most APIs for 45% of respondents, followed by China (25%) and Europe (19%). ‘Companies in the EU and the US have to work with their suppliers and emphasise to them the value of quality. Purchasing departments must be made aware that the game has changed,’ stresses Girish Malhotra, President of Epcot International, an API specialist. ‘Quality can no longer be taken for granted, and a signed paper is no guarantee.’

Outsourcing is becoming a more important strategy in formulation, responses suggest, with 56% saying that they are outsourcing or partnering with other organisations on drug formulation.

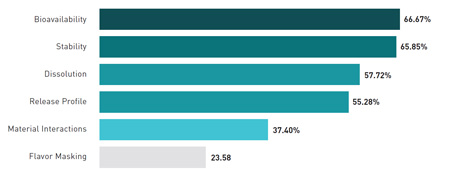

What is the most urgent formulation challenge today?

Most respondents say that their formulation efforts now focus mainly on solid dosage forms, and 62% say they are working with extended release or orally disintegrating forms. Bioavailability is cited as the top technical challenge in formulation, followed by stability, dissolution, and release profile. Materials interactions and taste masking are considered important, but less urgent, concerns.

Process analytical technology (PAT) and pharmaceutical Quality by Design (QbD) are being used in more formulation projects, the survey results suggest. Nearly 35% of respondents say they are using both, while a similar proportion plans to use them in the future; but 29% say they aren’t using either.

Brian Carlin

‘So 65% of the industry is waiting to see if QbD really works... when the concepts have already been proven to work in every other industry in the world, from cake mixes to paint to cars,’ says Emil Ciurczak, independent NIR spectroscopist and PAT expert.

However, Carlin takes a more optimistic view: ‘The ANDA checklist is being updated to include elements of QbD,’ he points out. ‘As such, ANDAs will not be accepted for filing without these elements.’

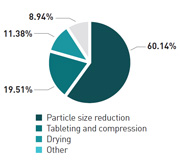

With solid dosage forms still representing 70% of the market, particle size reduction (60%) and tableting and compression (20%) are seen as the operations most difficult to control. One solution to this problem could be an increased use of cross-functional teams, with 21% of respondents actively hiring and 35% planning to hire more material scientists.

What is the most difficult unit operation to control?

‘Materials science is a good addition to the diverse range of expertise required for good QbD,’ notes Carlin, ‘but over-reliance on any discipline can introduce risk if other relevant areas of expertise are not included.’

According to Chris Kilbee, Group Director, CPhI & Pharma, CPhI’s first monthly insight report highlights some striking points, particularly in relation to quality and inspections. ‘It is impossible in a globalised environment to inspect every pharmaceutical ingredients plant on the planet, so independent certification is a must,’ he says. ‘And in fact, it is likely that as certification improves, pharma will increasingly look to outsource the development process and it is from this increased competition that solutions to formulation issues will be found.

‘In the future, this will enable drug targets that were previously unworkable and reformulations of existing compounds to make it through the development cycle and on to commercial supply.’