The first peptide drug to be approved was the hormone insulin, for diabetes, in 1923. Since then, the number of peptide drugs receiving marketing authorisation has been increasing.

There are currently more than 60 approved peptide drugs in the US, Europe and Japan, with more than 150 in active clinical development and 260 having been tested in clinical trials.

From a value of $33.3 billion in 2021, the global peptide therapeutics market is projected to reach $64.3 billion by 2031, growing at a CAGR of 6.8%.1

This is largely being driven by the rising incidence of cancer, as well as metabolic disorders such as osteoporosis, obesity and diabetes. This forecast growth is expected because of the initiatives currently being undertaken by many companies to investigate the development of new drug candidates.

Here, Dr Kevin Robinson (KSR) talks to Peter Timmerman (PT), Chief Scientific Officer, Peptides, and Ehab Alramahy (EA), Head of Peptide Division, from Biosynth about this market and how they have built a peptide supply division to support drug development companies.

Focused on the entire peptide research, development and commercialisation process, across global sites, it offers the flexibility to meet the needs of those developing novel peptide-based treatments and diagnostics.

KSR: Tell me more about peptide therapeutics and their significance. Having been around since 1923, why are they coming to the fore now?

PT: Knowledge, know-how and capabilities have all been key to the development of peptide therapeutics. We have seen a significant increase in peptide manufacturing capabilities that have resulted in better stability, bioavailability and specificity. This means that peptide drugs can now compete better with established SMDs and/or mAbs.

On top of that, our increased understanding of biological targets and the ability to design peptides to selectively target specific proteins and protein receptors have been combined with a better awareness of the concept of using peptides for targeted therapies.

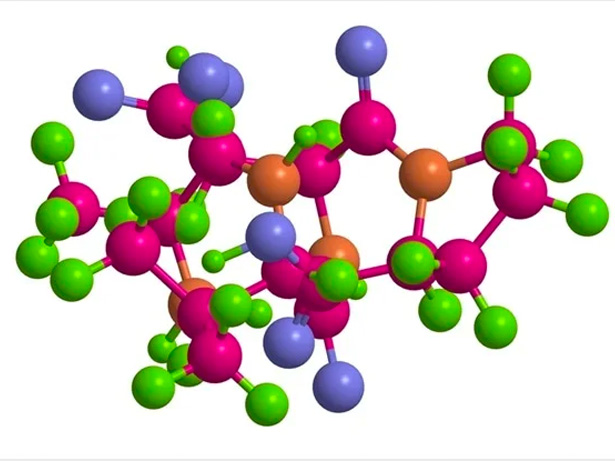

Consequently, more peptide products are reaching the market. An illustrative example is the novel cancer theranostic, Lutathera, consisting of a radio-tracer (Lu177-oxodotreotide) connected to an SS-constrained somatostatin-antagonist, which acts as a “homing’ device.”

It shows the massive potential of radio-labelled peptide therapeutics in the field of oncology, particularly for the treatment of pancreatic cancer, for which other type of drugs (mAbs and SMDs) have so far failed to deliver a viable solution.

Another example is an oral peptide drug against PCSK9, which is related to the reduction of cholesterol blood levels in patients with hypercholesterolemia.

The drug was developed by Merck (MK-0616) and the company recently initiated a Phase III clinical trial in patients. The good news is that this is just the start of this fascinating new field; there are many more novel peptide therapeutics yet to come.

The main reason for this is that methods for the high-throughput synthesis and screening of constrained peptides — such as phage display libraries (PDLs) or mRNA libraries — has only recently (10–15 years ago) become available.

Such techniques enable the identification of very high-affinity and highly selective peptidic binders to any protein target of interest, which means that peptide drugs for basically every possible target or disease can now be developed.

And then there’s the enormous success of the top-selling GLP-1-based therapeutics (Ozempic and Wegovy) for the treatment of diabetes and nutritional deficiencies.

In fact, all GLP-1-based therapeutics are “hot” as they help people who are overweight or morbidly obese to quickly lose weight. The number of people facing such problems is growing fast, with most countries having close to 50% of their population struggling with excess weight issues.

This and other factors recently made Novo Nordisk, the organisation that markets Ozempic and Wegovy, the most highly valued company in the world.

KSR: In which therapeutic categories are peptides having the greatest success (currently and in development) and why?

PT: The peptide therapeutics that have been most successful are those for metabolic diseases such as diabetes and nutritional deficiency. These drugs are derived from the natural hormone, GLP-1, which means that development started many years ago.

Generally speaking, drugs derived from natural hormones or their antagonists have a head-start when compared with de novo versions, the discovery of which only started more recently.

The second biggest area is oncology, with another key application being eye diseases such as wet age-related macular degeneration (wet AMD) or diabetic retinopathy, for which peptide therapeutics are being developed.

There’s also the field of antibiotics, wherein the majority of available drugs are peptidic and constrained in nature (vancomycin, for example).

KSR: How do you see the peptide therapeutic sector developing in the future?

PT: The GLP-1 drug market will continue to grow rapidly. Owing to high demand, there is already a global shortage of these products.

That will get even worse now, following the discovery that patients treated with Wegovy experienced a 20% reduction in the incidence of heart attacks, strokes and other heart-related diseases. Such a vast decrease has never been seen before and it was this news that spiked Novo Nordisk’s share price.

Also, the theranostics market will further contribute to the anticancer field and new drugs to treat eye diseases, such as THR-149 from Oxurion (currently in Phase II/III clinical trials), will pop up.

Moreover, there are more than 60 novel peptide-based drugs in clinical trials, some of which will definitely be future market leaders. And let’s not forget the development of orally available peptide drugs (MK-0606 to control high cholesterol levels, for example).

KSR: Are there any particular hurdles that are unique to peptide therapeutics compared with SMDs and/or biologics?

PT: One challenge is production. There is no drug class for which the atom-efficiency for production is lower than that for peptides.

For example, Viagra has an Environmental Impact Factor (E-factor) of 6.4, which is roughly the kilograms of raw materials minus the kilograms of desired product, divided by the kilograms of final product.

For comparison, the E-factor to produce the heptameric peptide H-FIVALVF-NH2 is 3425, which means that 3426 kg of waste is produced to make of 1 kg of this peptide!

One possible way to reduce those numbers is to avoid solid phase peptide synthesis (SPPS), which is the technique used at the majority of sites for small-scale peptide production.

By contrast, liquid phase peptide synthesis (LPPS) removes the need for polymeric resins and can even accommodate a switch to recombinant synthesis procedures using a fungal or bacterial DNA expression system.

The problem here, though, is that the synthesised peptides are immediately broken down by the same enzymes that produce them. To prevent this, the peptide must be fused to a carrier protein (which can be cleaved off later) to increase the overall stability.

However, this again reduces the atom-efficiency enormously as the cleaved off carrier protein is essentially waste material.

KSR: How can Biosynth offer support? What are the benefits of using the same outsourcing partner from discovery through to manufacturing and fill-finish?

EA: Our mission is to simplify our customers’ supply chain. We want them to focus on what they’re good at, which is the development of drug products. We then take care of production and issues such as those that Peter describes above.

With more than 40 years of expertise, we can use our collective knowledge to expedite our customers’ timelines and ensure the highest levels of quality and compliance.

Having the same outsourcing partner comes with many advantages. We know the peptide’s history and the customer's requirements, so we can streamline progression through the different stages.

Doing the preclinical work is essentially early stage process development, so we can leverage that knowledge to scale-up more efficiently. Long-term relationships enable us to better understand and support our customers.

KSR: Are there certain types of companies that find an end-to-end offering particularly attractive?

EA: Not really. It’s by design that our services range from discovery to fill-finish, from small- to large-scale and from research to GMP grade.

There are a lot of companies out there that focus on the super large-scale, but we’re not one of them; we currently work with academic institutes, start-ups with innovative projects and blue-chip companies. Our capabilities are quite appealing to a broad array of businesses, from diagnostics to biopharma.

When customers come to us, they don’t have to wait months to get a production slot. Many of them are in the early stages and looking for a partner that can work with them eye to eye. Our Project Management team works collaboratively with our clients to bridge the gap between the two organisations and build a coherent partnership.

Additionally, we provide access to world-leading scientists to help them design, optimise and deliver their peptides. Just thinking about our neoantigen platform, I can cite an example when speed was of the essence to get treatments made and delivered to patients.

We produced and shipped the peptides just 4 weeks after receiving the order. Patients need that speed and we can fulfil that promise. We are filling the market need for an end-to-end offering that combines high speed and quality with a true partnership.

Reference

- www.alliedmarketresearch.com/peptide-therapeutics-market-A11226.