With pharmaceutical and biotechnology companies seeking high-quality, flexible solutions for drug development and manufacturing, Ofichem is aware of the trends and challenges that clients have —and will face — throughout 2025/2026 and offers effective solutions.

Manufacturing Chemist (MC) spoke to Alessia Cogotti (AC), Business Unit Manager, Drug Substance, to find out more.

MC: Looking back, what were the most significant industry shifts or developments in 2025?

AC: In 2025, the small molecule contract development and manufacturing organisation (CDMO) sector moved from expansion-led growth towards a more disciplined, value-driven approach.

After several years of heavy investment in capacity and scale, CDMOs were required to sharpen their focus on reliable delivery, responsiveness and dependable execution.

At the same time, a challenging funding environment for biotechs slowed pipeline progression and made sponsors more selective in their partner choices.

As a result, partnership decisions were increasingly based on trust, predictability and the ability to work closely with customers to progress programmes efficiently … rather than on breadth of capabilities alone.

Geopolitical risk also moved from a background consideration to a core strategic factor. Supply security, regional manufacturing footprints and regulatory alignment gained prominence in outsourcing decisions, with Europe increasingly viewed as a stable and dependable manufacturing base.

Sponsors have recognised that resilience, predictability and proximity to regulated markets matter as much as cost when selecting CDMO partners.

Another continued trend was the evolution of the sponsor-CDMO relationship.

The industry moved further away from transactional outsourcing towards collaborative partnerships, with CDMOs expected to contribute development, design and route scouting, as well as regulatory and commercialisation advice.

In this environment, technical competence alone was insufficient and transparency, communication and collaboration became decisive differentiators.

MC: What key trends defined your sector in 2025?

AC: Several defining trends shaped the small molecule CDMO sector in 2025. First, complexity continued to increase.

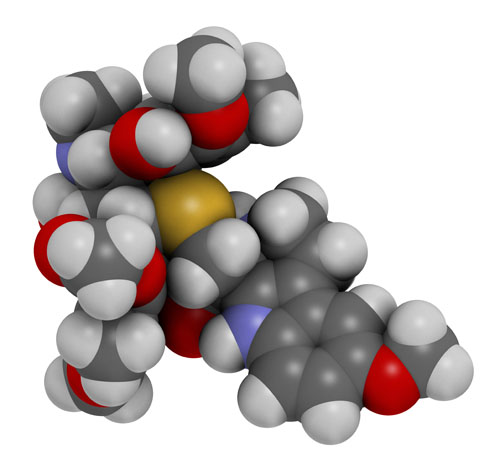

Small molecule programmes increasingly involve challenging chemistry, novel modalities such as proteolysis targeting chimeras (PROTACs), oligonucleotides and bioconjugates, and tighter development timelines.

This favoured CDMOs with strong scientific depth and flexible development capabilities.

During the past year, biotechs faced sustained funding constraints, which changed outsourcing behaviour. Sponsors became more selective and leaned towards partners that could derisk development with expertise rather than scale alone.

CDMOs that offered route scouting, development problem-solving and close collaboration were better positioned to support clients through uncertainty.

Additionally, sustainability moved from aspiration to expectation. Investments in greener technologies, including flow chemistry, gained momentum as pharmaceutical companies increasingly considered environmental impact alongside cost and speed.

Together, these trends reinforced a clear message in 2025: success depends on scientific quality, resilience and partnership, in addition to capacity.

MC: Which changes in 2025 had the biggest impact on your business or customers?

AC: The most impactful change in 2025 was the shift in how customers saw value.

With funding pressure across the biotech sector, clients increasingly sought CDMOs that could accelerate decision making, anticipate technical challenges and provide development flexibility rather than simply execute predefined work packages.

This reinforced the importance of scientific expertise and close collaboration.

For Ofichem, expanding development services by acquiring a non-GMP site aligned well with this trend. It allowed earlier engagement with clients and better integration between development and manufacturing, which customers increasingly value when timelines and budgets are constrained.

Geopolitical considerations also had a tangible impact. Customers placed greater emphasis on supply security and regional manufacturing, with Europe gaining importance as a stable and reliable production base.

Ofichem’s strong European manufacturing footprint and fully Europe-based production provided reassurance in terms of regulatory alignment, continuity of supply and risk mitigation.

Although cost sensitivity remained, 2025 reinforced that the lowest-cost option is not always the lowest-risk one.

MC: What trends or challenges are you preparing for in 2026?

AC: Looking ahead to 2026, one of the main challenges for the small molecule CDMO market will be balancing investment discipline with the need to support increasingly complex development programmes.

As small molecules continue to evolve towards greater structural and synthetic complexity, CDMOs must ensure they have the scientific depth, analytical capabilities and development infrastructure to support these demands.

Funding uncertainty, particularly among early stage biotechs, is also likely to persist. This will continue to favour CDMOs that can engage early, provide specialised development expertise and act as collaborative partners rather than transactional suppliers.

Sustainability will be another key focus. Pharmaceutical companies are increasingly assessing CDMOs on environmental performance, not just cost and timelines.

Integrating green chemistry approaches such as flow chemistry at scale, without compromising efficiency, will be critical.

Finally, geopolitical risk remains a structural challenge. Maintaining secure, Europe-based production while offering flexibility and resilience will be central to supporting customers as they navigate an uncertain global environment.

MC: Where do you see the greatest opportunities or risks emerging in 2026?

AC: The most significant opportunities in 2026 lie in supporting complex, differentiated small molecule programmes.

Modalities such as PROTACs, oligonucleotides and bioconjugates are expected to continue outpacing growth in the traditional small molecule field, creating strong demand for CDMOs with advanced chemistry and development expertise.

CDMOs that can combine scientific depth with reliable execution will be well-positioned to benefit.

There is also a significant opportunity in sustainability led innovation. As environmental criteria increasingly influence partner selection, CDMOs that can demonstrate tangible progress through technologies such as flow chemistry will gain a competitive advantage.

On the risk side, prolonged funding constraints among biotechs could delay or cancel projects, increasing volatility in development pipelines.

Geopolitical uncertainty also remains a risk, particularly for globally distributed supply chains. Although European manufacturing offers resilience, it requires continuous investment in efficiency and compliance to stay competitive.

Overall, the balance of opportunity and risk in 2026 will prioritise focused CDMOs with precise strategic positioning, strong scientific capabilities and a reputation for reliability.

MC: What innovations or shifts do you expect will shape the industry in the year ahead?

AC: In 2026, innovation in the small molecule CDMO sector will be driven less by headline capacity expansions and more by enabling technologies and operating models.

Flow chemistry is a clear example, offering improved sustainability, scalability and control for complex reactions … and we expect broader adoption as CDMOs seek greener and more efficient manufacturing solutions.

Another significant shift will be the deeper integration of development and manufacturing. Sponsors increasingly want seamless transitions from early development to commercial supply, particularly for complex molecules.

This favours CDMOs that can support programmes throughout the lifecycle with consistency and scientific continuity.

We also expect continued maturation of the partnership model. CDMOs will increasingly act as extensions of their clients’ organisations, contributing to development strategy, risk assessment and regulatory planning.

Transparency, predictability and trust will be as important as technical innovation. The industry focus will continue to move towards complexity rather than volume.

CDMOs that invest in R&D, analytical science and specialised expertise will shape the next phase of growth in the small molecule sector.

For more in this series