In the pharmaceutical sector, for example, digitalisation and data analytics can reduce the high levels of downtime typically experienced by pharmaceutical plants. Although, the various dimensions of productivity differ between industries and countries, increased manufacturing productivity — the ability to either produce the same number of products for less or more products for the same — has a clear and calculable positive effect on costs and margins.

This effect — which we have called the Digitalisation Productivity Bonus (DPB) — is the focus of our latest research, which captures testimony from more than 60 international industrial companies, expert management consultancies and academic specialists based in 11 countries. The resulting model estimates the DPB for different industries. The potential global DPB (all manufacturing sectors) is estimated to be between 6.3 and 9.8% of total annual revenue by 2025.

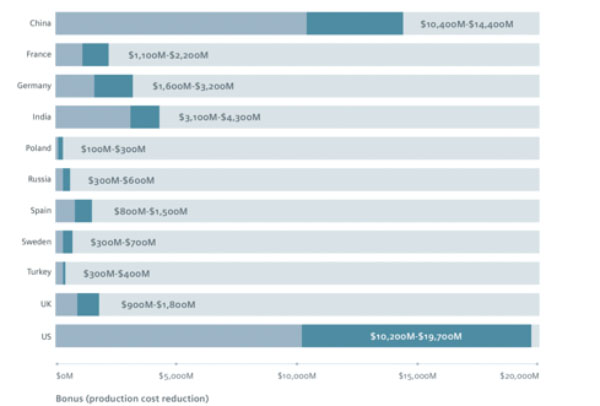

Additionally, the research looks specifically at the potential gains for the pharmaceutical manufacturing industry. Applying the model to this sector in each of 11 countries provides an estimate of the DPB to be gained as a result of investment in digitalised Industry 4.0 technology.1

The resulting totals are an estimate of the potential financial gain for the pharmaceutical industry as a direct result of improvements in manufacturing productivity from digital transformation. In the global pharmaceutical manufacturing industry, it is estimated that conversion to digitalised technology could deliver a DPB of between $67 and $105 billion (Figure 1).2

Figure 1: Estimated DPB: reduced production costs resulting from conversion to digitalised technology in the pharmaceutical industry